On a global scale, the energy transition has largely accelerated in the economic context of recent years, although its evolution in the coming years is uncertain. As proof, the size of the global market for the six main mass-produced low-carbon technologies - solar photovoltaics, wind power, electric vehicles, batteries, electrolysers and heat pumps - almost quadrupled between 2015 and 2023, reaching over $700 billion, or around half the value of all natural gas produced worldwide. This growth has been driven by the massive deployment of clean technologies, particularly for electric vehicles, solar photovoltaics and wind power. With the policies announced for the coming years, the market for these low-carbon technologies could triple by 2035 to over $2,000 billion, roughly the size of the global crude oil market today.

The IEA recently published its report "Energy and Technology Perspectives 2024". (ETP-24), in which it highlights the opportunities that exist for emerging economies to become major players in the manufacture and trade of new low-carbon technologies. By collecting country-by-country data on more than 60 indicators, assessing the business environment, energy and transport infrastructures, resource availability and the size of domestic markets, the IEA has identified North African countries, and Morocco in particular, as potential major players in its scenarios analyzing the industrial sectors for electric vehicles and their batteries.

Jules Sery, IEA consultant and co-author of the report, gives us the main points.

Interview by Karim Lasri

KL: Morocco has a number of assets that position it as a high-potential player in the supply of electric vehicles and batteries. What existing infrastructures make it a key link in this industry?

In total, the country now boasts an annual production capacity of 650,000 vehicles, mainly from the factories of European manufacturers such as Renault and Stellantis, whose investments have considerably boosted the industry in the kingdom. who have invested in the country to take advantage of lower labor and energy costs.

Morocco's proximity to the huge European market and its robust transport infrastructure are also favorable conditions for the emergence of Morocco as a strategic industrial partner. The port of Tangier Med, one of the largest in the Mediterranean, is a prime example of this infrastructure, which facilitates fast, efficient shipments, reducing logistics costs and delivery times.

KL: In addition to the infrastructure you mentioned, does Morocco have the primary resources that are crucial to its economic potential in the electric vehicle and battery sectors?

JS:Phosphate mining is often thought of as Morocco's main mining activity, and to a lesser extent cobalt mining. The country has the largest known reserves to date. This mineral is better known for its use in the manufacture of chemical fertilizers essential to modern agriculture, than for its critical use in the manufacture of Li-ion batteries for EVs. In fact, today, two technologies in particular, or cathode chemistry, share the global Li-ion battery market: NMC (Nickel, Manganese, Cobalt) batteries, preferred in Western markets, and LFP (Lithium Iron Phosphate) batteries, the majority in the Chinese market. Over the past 5 years, the growth of China's Li-ion battery industry has boosted the share of LFP technology in the global EV battery mix, doubling it between 2020 and 2023 to 40% of the global market. In industry jargon, this is known as the "LFPification" of the global lithium-ion battery market. The low manufacturing cost of LFP batteries compared with their NMC counterparts indicates that this trend is set to strengthen in the short to medium term, barring any major technological disruption in the industry.

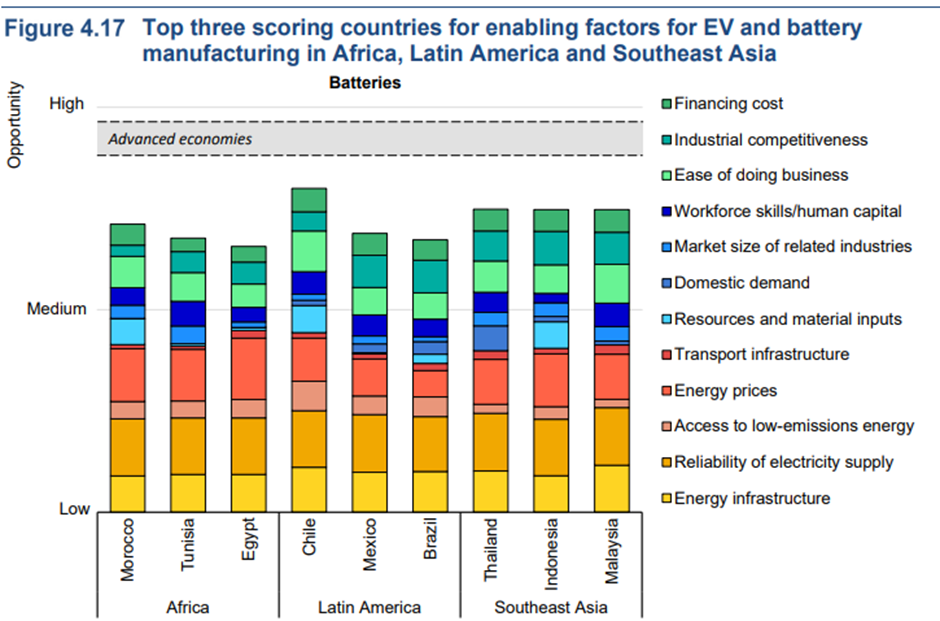

The chart above shows the main potential players in the manufacture of EVs and batteries in Africa, Latin America and South-East Asia. Morocco emerges as a potential leader on the African continent, along with Tunisia and Egypt. The respective contributions of multiple factors, ranging from energy infrastructure to industrial competitiveness and domestic demand, are shown.

In this context, Morocco has the potential to capitalize on its significant phosphate resources to develop a LFP battery industry, where Europe has historically focused on NMC technology due to its higher energy density. In addition, the country has low-cost energy resources and easy access to low-carbon energy, which could contribute to the emergence of such a sector (Africa's largest solar complex is located in Ouarzazate, with a capacity of 500 MW). The availability of skilled labor, at lower cost in some economies, is also an attractive factor for potential foreign investors wishing to take advantage of this range of resources.

KL: Thanks to these advantages, Morocco has already attracted Chinese investment in the production of electric vehicles and batteries. What are the current projects?

JS: Indeed, several foreign investors are interested in setting up a battery industry in Morocco, in light of the advantages mentioned above. These include China's CNGR Advanced Material Company and Gotion, which have announced short-term investments of $2 billion and $6.5 billion respectively. Gotion plans to build an industrial complex based on LFP technology, capable of producing 100 GWh per year. To give an order of magnitude, if this project comes to fruition, its production capacity will exceed that of LG Energy Solution, currently Europe's largest battery plant in operation, with a capacity of 86 GWh. Other Asian manufacturers, notably South Korea's LG Chem and China's Youyshan, have also recently announced major investments in the country. All these projects will enable the Moroccan battery industry to develop considerably, to meet the strong demand created by electric vehicle sales in Morocco's main neighboring markets, first and foremost Europe.

KL: The global economy is marked by a massive increase in investment in clean energy: 50% increase in 2023. However, well-designed trade policies are considered essential if the transition to clean energy is to continue to accelerate.In this context, could Morocco's favorable trade agreements attract new investment in these sectors from partners other than China?

JS: Morocco has signed major free-trade agreements with its main trading partners, starting with the European Union in 1996 and the United States in 2004. These trade agreements enable Morocco to free itself from tariffs and quotas that could hamper the competitiveness of its exports. In addition, the free-trade agreement signed with the United States has a double advantage, since it allows EVs equipped with batteries manufactured in Morocco to qualify for the tax credit granted under the Inflation Reduction Act (IRA). Taken together, these trade agreements offer the Moroccan EV and battery industry tremendous export opportunities, enabling domestic production to considerably outstrip the still nascent and underdeveloped domestic demand for these technologies.

KL: In view of all these factors, what projections can reasonably be made regarding the development of the electric vehicle sector in Morocco?

JS: As part of our ETP-24 report, we have developed a model implementing all the conditions favorable to the emergence of an EV and battery industry in Morocco, in order to assess future production and trade trajectories for these technologies under different scenarios.

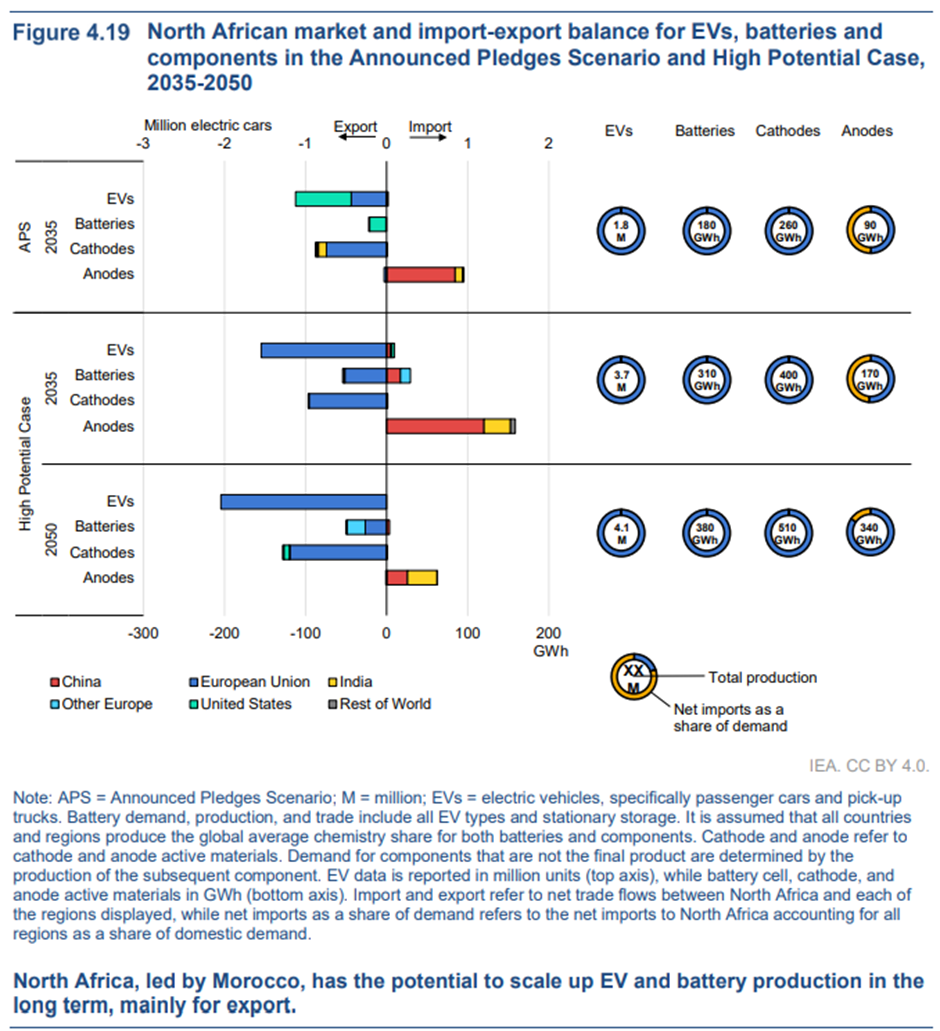

The graph above shows, among other things, the import-export balance of EVs and batteries, in millions, for the countries of North Africa, and in two scenarios: that of the targets already set by governments (APS)and a more optimistic scenario (High Potential Case) which assumes that the economies concerned exploit all their competitive advantages by overcoming many of the barriers to market development. It shows the potential for exports from North African countries, and makes explicit mention of Morocco's leadership position, due to its ability to scale up EV and battery production.

The "New commitments announced" scenario (Announced Pledges ScenarioAPS) examines what would happen if all the national energy and climate targets set by governments, including net zero emissions targets, were met in full and on time. In this scenario, the IEA estimates that North Africa, with Morocco at the forefront, will produce almost 1.8 million electric vehicles by 2035, of which 70% would be destined for export to the USA and the European Union. This production of EVs will in turn generate a battery demand of almost 200 GWh, entirely met by local production. A second scenario, known as the "High Potential Case" (High Potential Case(HPC) scenario has been developed to estimate the impact on global production and trade of a demand for EVs and batteries compatible with a goal of zero net CO2 emissions by 2050. In our HPC scenario, Morocco could see its EV and battery production reach over 3.5 million and 300 GWh respectively in 2035. By 2050, in the HPC scenario, the development of the Moroccan industrial sector and increased global demand for EVs and batteries could boost domestic production to over 4 million EVs, more than half of which would be destined for export to the European Union.

KL: In conclusion, this recent IEA report highlights the considerable economic and strategic opportunities offered by the energy transition for countries like Morocco, which have a wealth of resources, a solid industrial infrastructure and an advantageous geographical position. With a clear vision and the right policies, Morocco has the potential to become a major player in the manufacture of electric vehicles and batteries, helping to meet the growing demand for low-carbon technologies.

Foreign investment, free trade agreements and low-cost energy resources reinforce this prospect. By capitalizing on these assets, Morocco can not only diversify its economy, but also play a key role in integrating emerging economies into the global electric vehicle and battery value chain.

The scenarios drawn up by the IEA show that Morocco's future in this sector is promising, provided we continue to attract investment and adopt strategies conducive to the country's industrialization and exports. This development could place the Kingdom firmly in the global energy transition dynamic.

These comments were collected by Karim Lasri

Link to the report "Energy and Technology Perspectives 2024" ETP-24